Envision by Assetview

Top

Extras

Envision

Envision

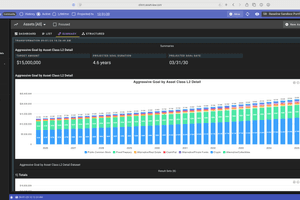

- Envision is AssetView's next-generation planning tool based on your portfolio that lets you evaluate how different investment strategies impact your future

- Easily explore what-if scenarios with levers that adjust rates of return and allocations by asset class, sector, geography, risk profile, and more — turning questions into real insights

- Project growth based on rates of return for individual asset classes

- Model the effects of rebalancing by asset class, sector, or geography

- And because Envision starts with your real portfolio—not generic assumptions—you get a true picture of where you're headed

- You see the probabilities, the risks, and the possibilities so you attain your best financial future

Vitals

Vitals

- TypePlanning System

- Power SwitchOn - Permanent

- PriceFree with subscription to AssetView

- DeveloperAssetView

- PrivacyCovered by AssetView's strict privacy policy

- AssetView EditionsAll

- Version1.9

Pricing

Free with a subscription to AssetView

Details

Details

Envision Your Best Future

- See your net worth today and how it evolves on any future date

- Pinpoint the exact date your net worth will exceed $N

- Know when you can retire with confidence

- Assess the feasibility of milestones like buying a second home or funding major investments

- Know when your passive income will surpass $N

- Track your inflation-adjusted buying power over time to protect long-term wealth

Powerful Levers to Shape Your Future

- Scenario testing → run “what if” analyses to instantly see the impact of changes

- Rebalancing strategies → test how shifting by asset class, sector, risk level, or geography affects outcomes

- Expected returns → adjust assumptions per asset class to explore best- and worst-case futures

- Situation-specific views → move seamlessly from a big-picture wealth summary to deep asset analytics

- Tax & liquidity planning → anticipate upcoming tax obligations and ensure liquidity for commitments

These levers let you see how small adjustments today reshape your future tomorrow

A Zoom Lens on Sensitivity Analysis

- Analyze your entire portfolio or zoom into accounts, asset classes, or individual assets

- Build custom dashboards that highlight the numbers that matter most to you

- Filter and personalize views to match your unique financial goals

Different decisions require different levels of focus — from high-level oversight to detailed drill-downs

🧩 Envision: Who It's For

👤 For HNWI

Envision delivers clarity across your future financial picture. Project net worth across all asset classes, forecast when passive income surpasses expenses, and know exactly when you can retire or purchase a second home with confidence.

💼 For Financial Advisors

Envision transforms client prep and reporting. Go beyond past performance with forward-looking scenario planning. Run projections in real time and demonstrate when clients will reach their key milestones.

🏛️ For Family Offices

Envision simplifies multi-entity wealth planning. Map beneficiaries, trusts, and partnerships, while projecting tax liabilities, liquidity needs, and rebalancing effects. Plan not only for today but across generations.

AssetView empowers you with the same sophisticated tool used by large institutions

Easy Setup, Big Payoff

- Ease → Built on assumptions that you control with levers

- Efficiency → far more informative, stable, and easier to tweak than complicated spreadsheets; save hours per week - more time living

- Simplicity → The Envision dashboard updates automatically with new financial data

- Confidence → Simplify your life and build your wealth with confidence

Minor effort, major impact

Envision - A Better Future

Envision is the best planning tool on the market

✨ Price → free with your subscription to AssetView

Run your first scenario with Envision today → AssetView risk-free trial