AV Private Funds

included in your Assetview subscription

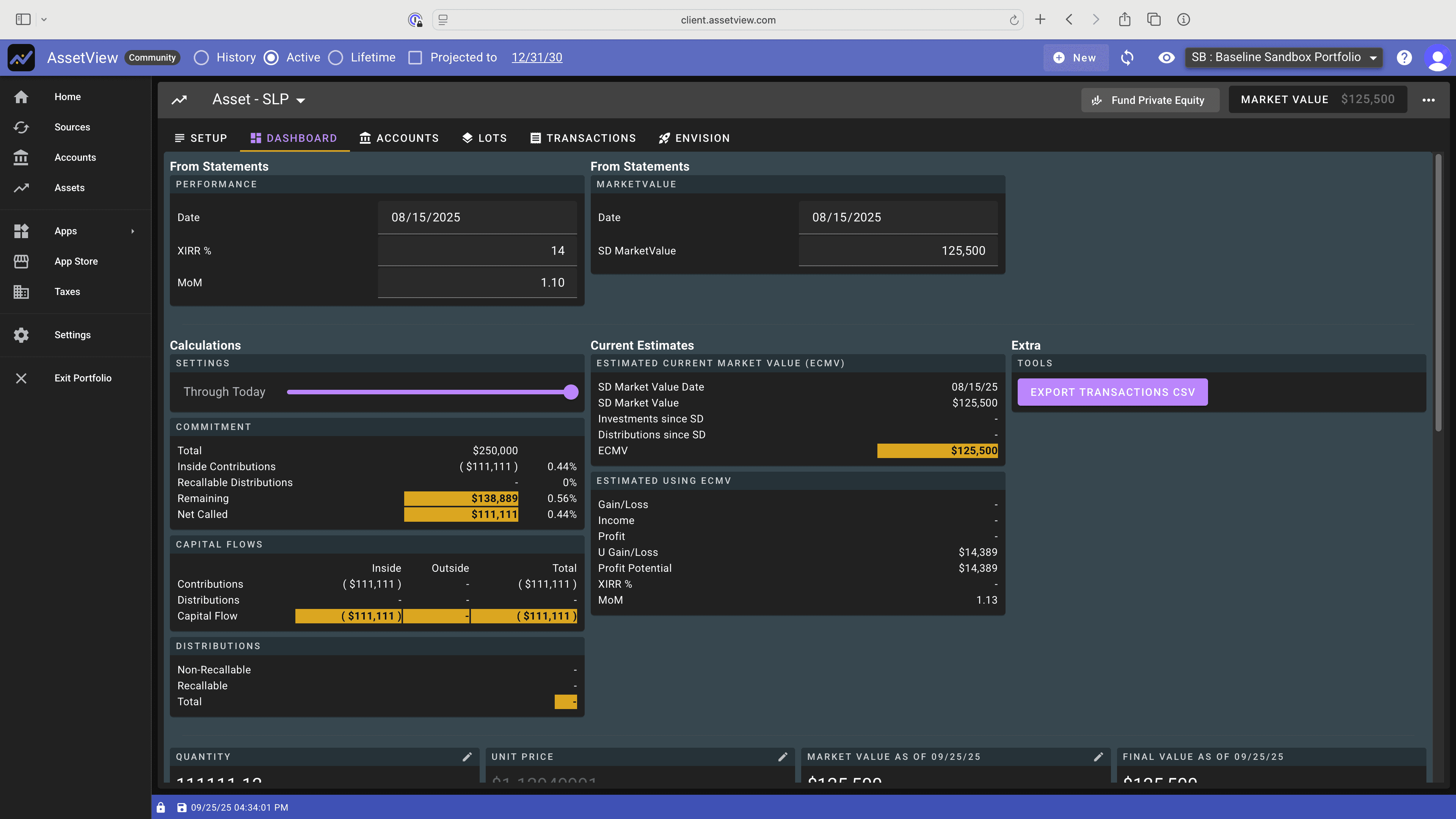

Manage your Commitments

Transparency, clarity, and coordination

- Centralized, comprehensive overview of your private fundsacross all sponsors, GPs, LPs, agents, brokers, custodians, administrators, auditors, legal counsel, compliance parties, and portfolio companies

- Private fund dashboardcalculates and tracks your remaining commitment, contributions, recallable and non-recallable distributions, stated valuation, calculated current valuation, and estimated economic gain

- Consistent performance analyticsapples-to-apples performance metrics to compare risk-reward tradeoffs across all private funds

- Manage private funds easily amongst other asset classesdashboards that aggregate and normalize data for private funds alongside stocks, alternatives, and real estate

- Analysis of your private fund positions and transactionssupports custom fields for tracking and managing unique traits per private fund

- Supports flexible ownership structures with tax preparationtrack anticipated tax liabilities, tax form receipt, submission to tax preparer, and incorporation into filing

- Detailed cash flow trackingprivate fund specific cash flows with complex ownership structures

- Lot trackingtracks investment dates and cost basis including fees

- Projected modeenables transactional level planning to manage commitments and cash

- Profit from institutional-level analytics usually reserved for family officesIRRs, multiples, cost basis, cash flow, unrealized gains, etc.

- Liquidityanticipate tax liabilities and liquidity needs

- Confidencemake smarter decisions with complete information

- See your true performance including feesknow how you're really doing

- Timeless effort collecting data, more time to focus on evaluating opportunities

AssetView's Value

granular tracking and a wide angle lens to execute on your private funds strategy

Flexible

all fund types

Zoom Lens

from your portfolio to your private fund holdings to a private fund transaction

Time Savings

manage your financial picture in one dashboard

Private, low cost, unified, powerful, insightful — AssetView excels