Financial Advisors

powering relationships

Grow Your Advisory

- Increase AUM → through visibility to your clients' unified portfoliosHelp allocate assets properly and add-value with AssetView's investment performance analysis and optimization tools

- Win Client Trust → with better financial planningAssetView combines the industry's best real-time roll-up transactional planning tool with Life Planner, the industry's best rules-based and life-event-based projection system

- Win Client Loyalty → by showing insights competitors can'tDifferentiate your services with easy, specific tuning to a client and/or situation

- Increase Your Scalability → by supporting more clients without adding staffLess effort preparing, more time advising and building new relationships

Relationship-Building with Clarity and Efficiency

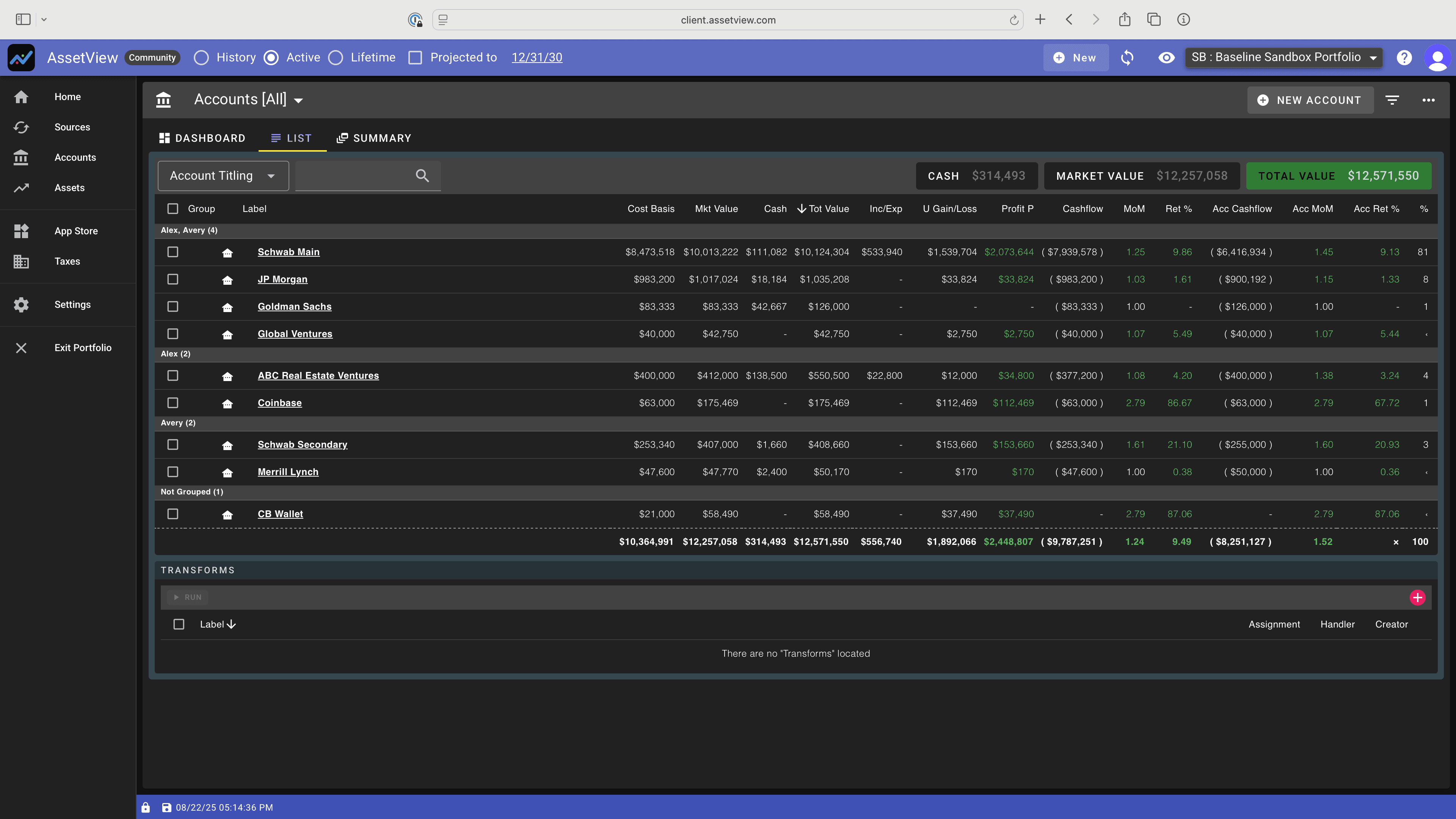

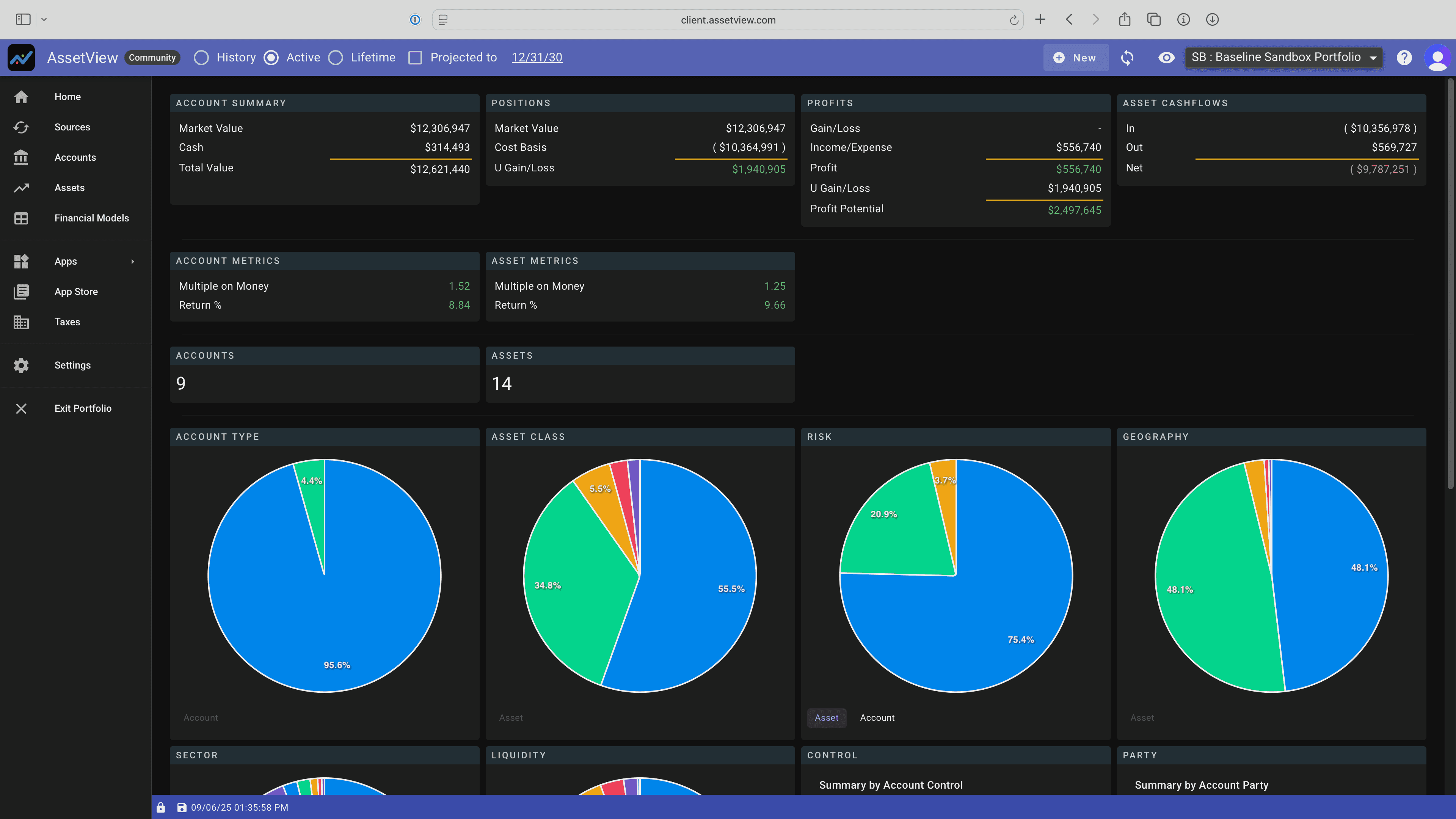

- Clarityone clear view for each client across their relationships and assets - no gaps

- Performancemake smarter decisions with complete information and better investment analysis

- Confidencevisibility into cash flows, tax impacts, and investment performance so you can advise in advance

- Professionalism and Custom Fitinsights presented clearly that are client and situation specific

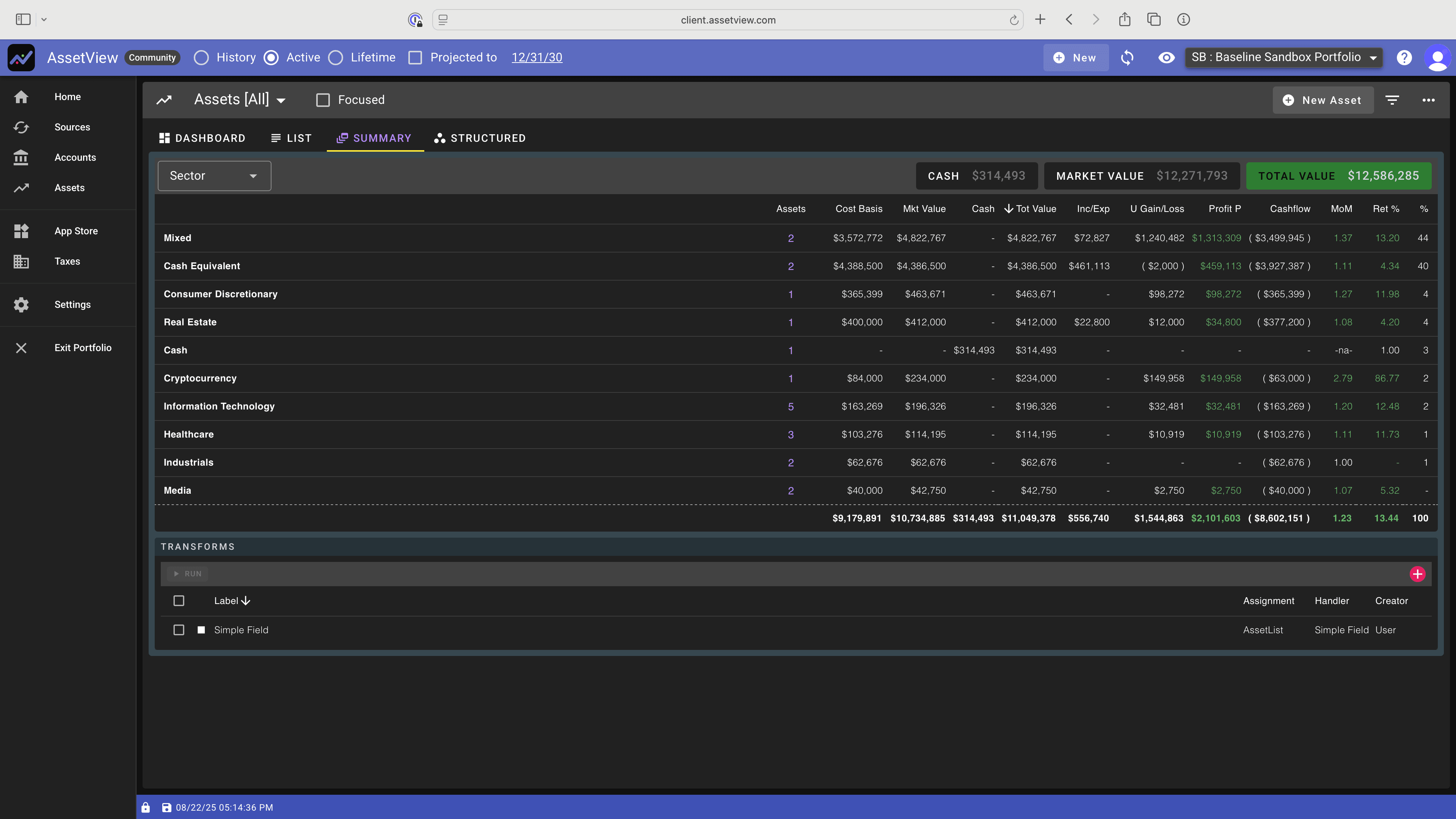

One Platform, Every Asset

- Increase AUMthrough visibility to your clients' unified portfolios

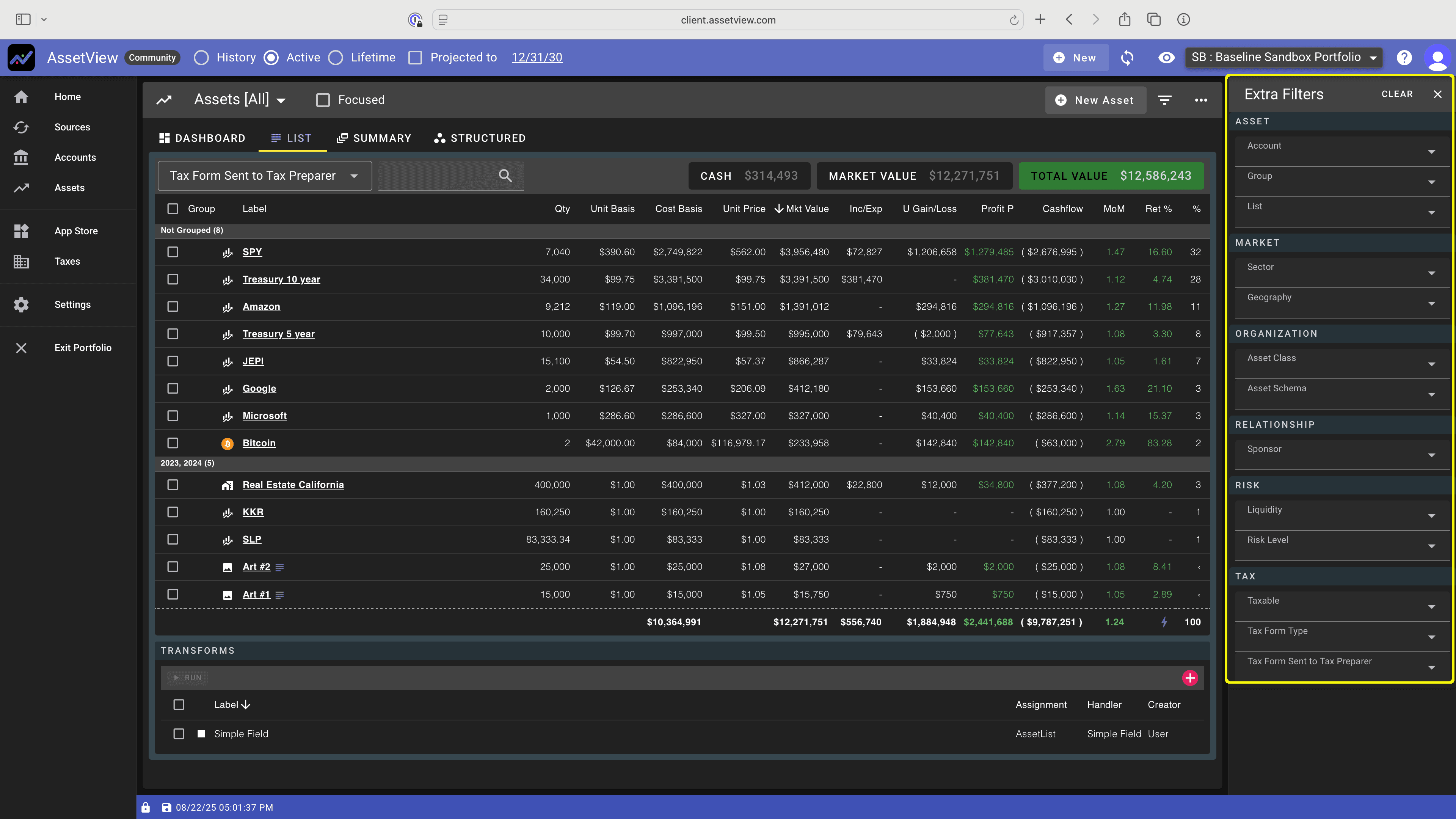

- Easily and securely provide a unified view for each clientcustodians, brokerages, banks, accounts, trusts, beneficiaries, and partnerships across all asset classes - no gaps

- Easily and securely provide holistic reportingacross public securities, private equity, real estate, crypto, alternative, LLC assets, etc. - no gaps

- Help allocate assets properlyadd-value based on AssetView's investment performance analysis and optimization tools

- Model, track, and project the full lifecycle of illiquid assets right alongside liquid holdingsreal estate, private funds, direct investments, or co-investments

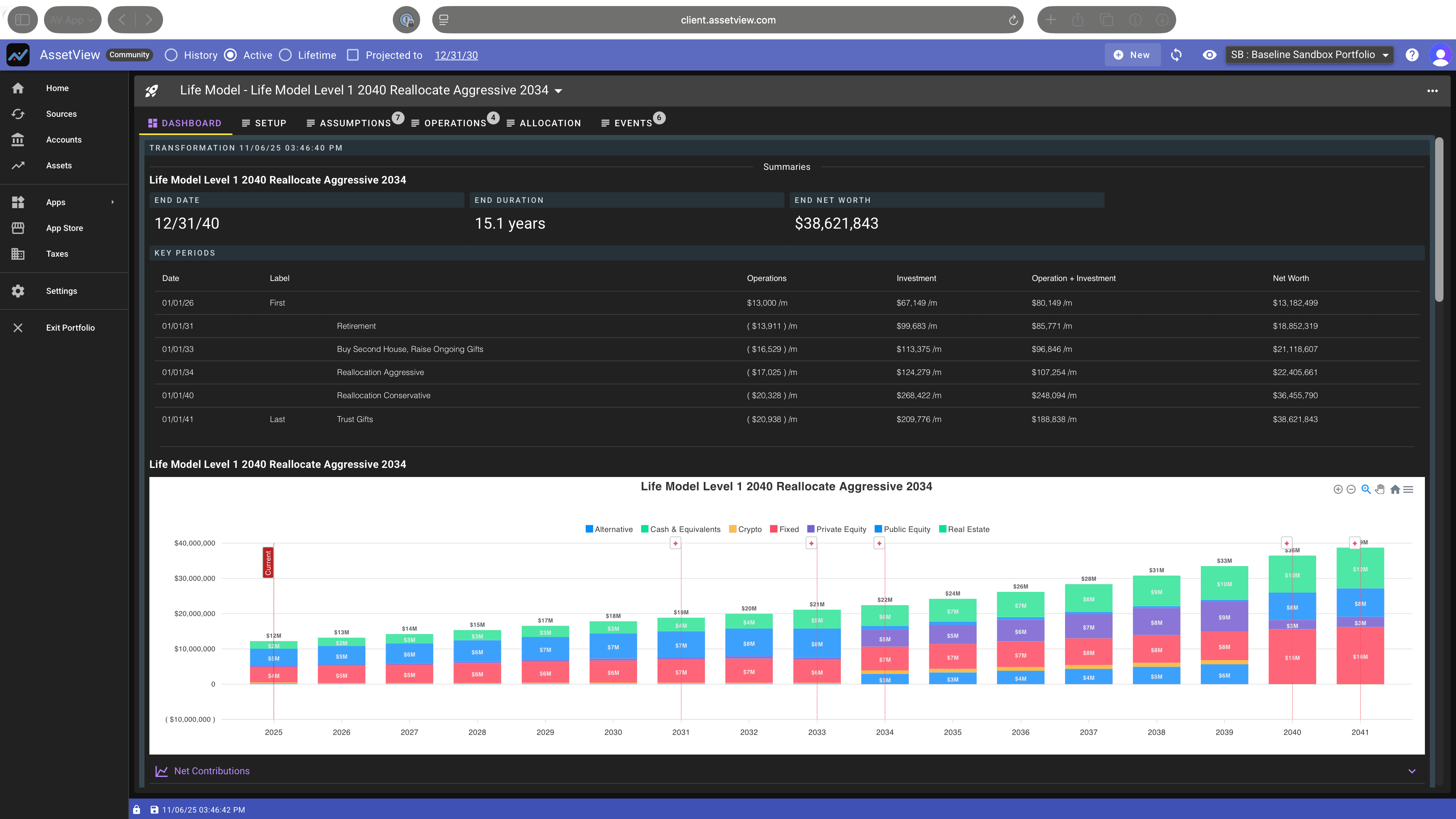

Life Planner For Your Clients' Best Future

- Net worth over timesee your clients' net worth today - and how it evolves on any future date

- Achievementspinpoint when your clients' net worth will exceed $N

- Project retirement preparednessdiscover when your clients can retire with confidence

- Milestonesplan ahead for client milestones like buying a second home or major investments

- Comfortknow when your clients' passive income will surpass $N

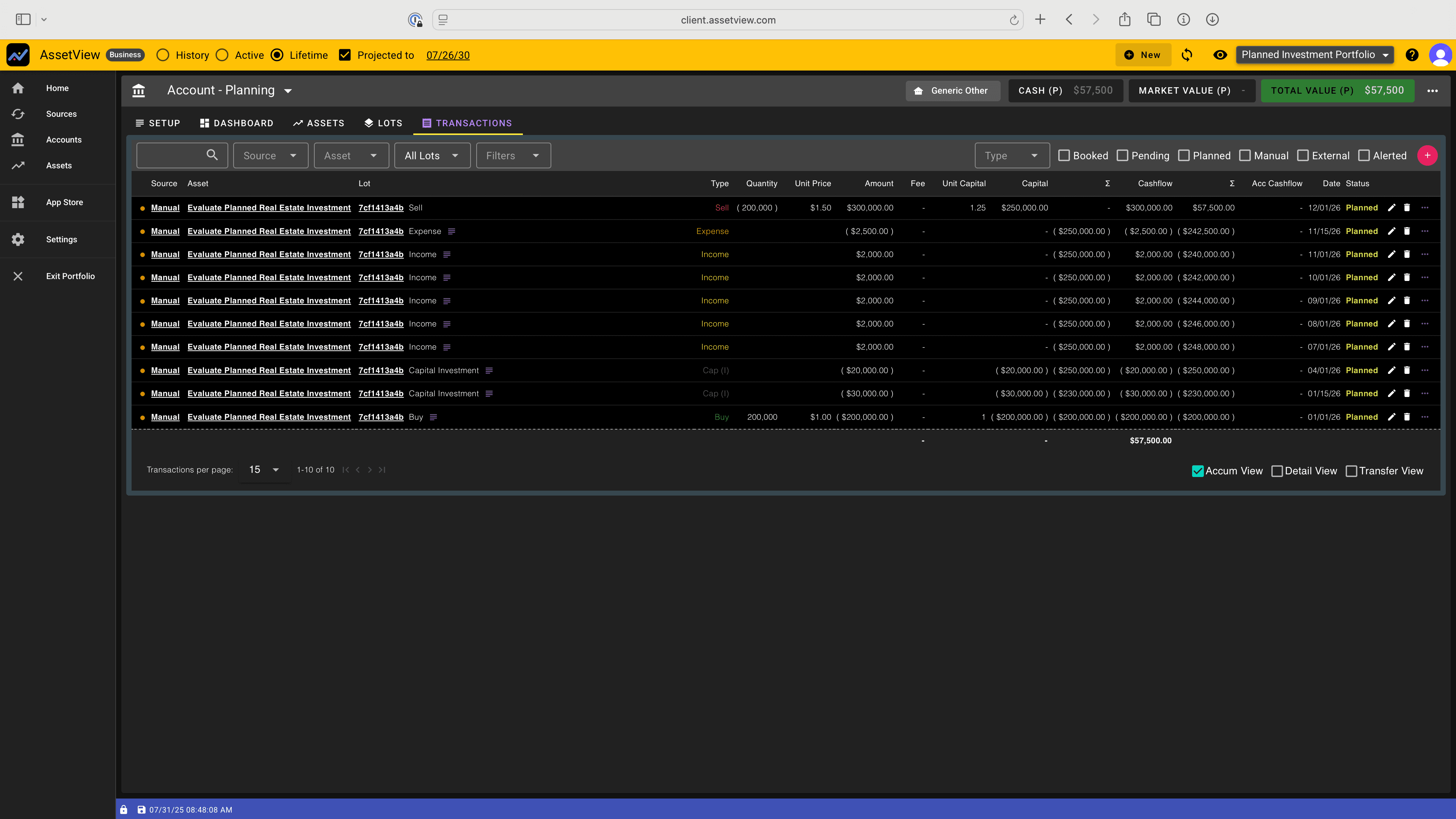

Transactional Planning

- Project cash flow scenarios, redemptions, and maturitiesdistributions and obligations are met smoothly, without last-minute stress

- AssetView supports "Active Projected", “Lifetime”, and “Projected Lifetime” views of wealthbased on transaction level projections

- AssetView also support rules-based projectionsat a portfolio, account, asset class, and asset level (e.g. see the projected effects of asset re-balancing)

- Benefit from forward-looking planningliquidity, taxes, and “what if” scenarios that help you prepare properly and quickly for client meetings and your clients' prepare for their financial future

- Anticipate and project cash flow scenarios, redemptions, and maturitiesdistributions (and other liquidity needs) and obligations (e.g. tax liabilities) are met smoothly, without last-minute stress — eliminate blind spots

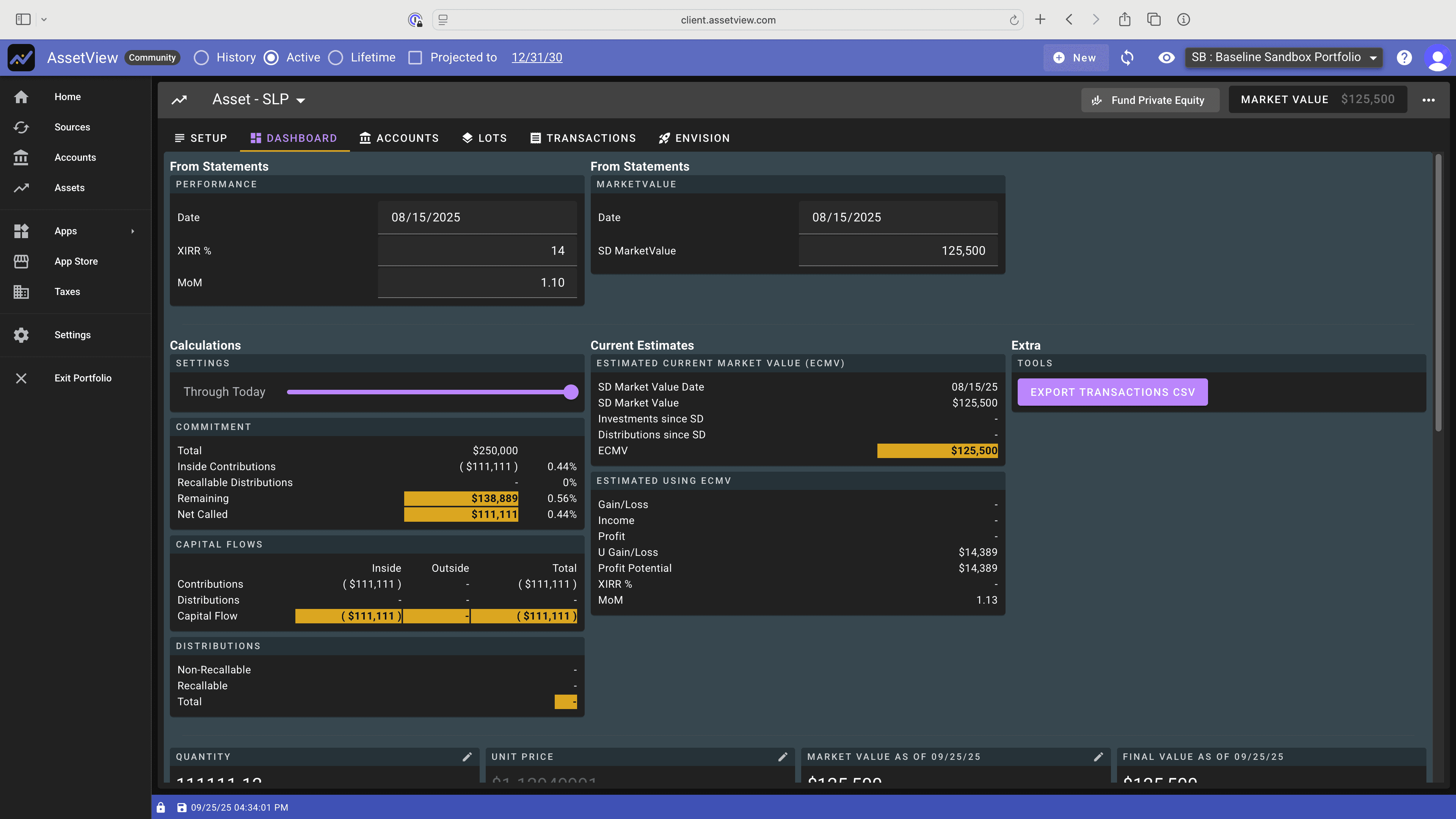

Performance Tracking

- See true performanceknow and share with your clients how they're really doing

- Accuracytransactional investment analysis with IRRs, multiples, lot tracked cost basis, cash flow, unrealized gains, etc.

- Real-time cash based return calculationseven when crunching high investment transaction counts

- Profit from institutional-level analyticsPower and detail

Privates Enlightened

- Easily keep tabson an otherwise time-consuming myriad of individual reports

- Supports all typesprivate funds, direct investments, co-investments, etc.

- Models, tracks, and projects the full lifecycle including capital calls, distributions, IRRs, multiples. etc.right alongside your clients' liquid holdings

Customize Views

- Tailored viewssee your clients' finances the way you want to see them - show your clients' their finances the way they want to see them

- Holistic view and helpful detailgo beyond standard custodial reports with fragmented snapshots

- Client specific viewsbig-picture wealth summaries for some, deep analytics for others

- Situation specific viewstailored insights that win trust

- Customizable dashboards

- Customizable data filtered views

It's Your Time

- More time advising and building relationshipsless time managing systems

- Easily present clients with professional, consistent deliverablessave hours per week

- Automatedreporting and performance calculations

- One sign-inall your clients' numbers → clarity

- Strategic and tactical planning in one placesupports long-term estate strategies and short-term investment tactics

- Simplicityunified dashboard with automated updates of financial data

AssetView Excels

AssetView Excels

Competitive Overview

| Feature / Dimension | AssetView | Most Systems |

|---|---|---|

| Privacy-First Architecture | ✅ AssetView is committed to privacy; personal investment data isn't shared or sold ✅ Credentials aren't stored ✅ Investors retain control over what data is shared and with whom | 🔻 Most competing tools have access to client personal investment data or require custodial control |

| Holistic Multi-Party, Multi-Asset Coverage | ✅ Tracks across all parties — traditional brokerages, crypto brokerages, banks, private funds, private placements ✅ Tracks all asset classes — public securities, crypto, real estate, private equity, hedge funds, venture, alternatives, banking, and planned transactions | 🔻 Most platforms either only handle traditional brokerage and banking, or require institutional scale to track alternatives |

| Performance Evaluation | ✅ AssetView analyzes historical, active, and projected positions ✅ IRR, multiple-on-invested-capital, cost basis, cash flow schedules ✅ Future-looking “what if” planning for planned investments/divestitures | 🔻 Most tools only show current positions |

| Transaction-Level Intelligence and Analytics | ✅ AssetView supports transactional detail across all asset classes ✅ AssetView rolls up transactions to lots enabling best-case decisions, even across brokerages, when closing a position | 🔻 Most tools only show positions |

| Planning | ✅ AssetView extends to forward planning, liquidity forecasting, and tax projections ✅ AssetView supports "Active Projected", “Lifetime”, and “Projected Lifetime” views of wealth based on transaction level projections ✅ AssetView also support rules-based projections at a portfolio, account, asset class, and asset level (e.g. see the projected effects of asset re-balancing) | 🔻 Many platforms stop at reporting; “Here's what you own" or show a simple portfolio level growth rate |

| Customizable Workflows & Dashboards | ✅ AssetView Apps Store lets you customize functionality ✅ Users can configure their dashboards, reporting, and analytics | 🔻 Competing tools are rigid: one-size-fits-all dashboards, with little flexibility |

| Entity + Relationship Mapping | ✅ Built for complex ownership structures: trusts, family entities, beneficiaries, joint accounts ✅ Clearly maps “who owns what,” not just “what exists” | 🔻 Most systems do not have flexibility in recognizing, nest, and enable filtering and views for organizational structures |

| Accessibility | ✅ AssetView has institutional-grade analytics accessible without enterprise overhead | 🔻 Many tools are either shallow or require enterprise-level coordination and effort |

| Trial Available | ✅ 30 days | 🔻 Few packages offer trials because they require a big, up-front commitment of money and time |

| Free Edition Available | ✅ Yes, sign up for Essential Edition that is free | 🔻 Most packages do not have a free edition or have models where your personal investment data is shared |

AssetView Advantages

AssetView Advantages

Competitive Matrix

| Feature / Dimension | AssetView | Addepar | Black Diamond | Kubera | eMoney Premier | RightCapital | MoneyGuidePro |

|---|---|---|---|---|---|---|---|

| Privacy & Data Control | ✅ Yes, credentials not stored, no selling of personal investment data | ✅ Enterprise-grade | ❌ Custodian-driven | ✅ Yes, subscription model | 🔻 Advisor-controlled; data stored in eMoney cloud, no resale | 🔻 Advisor-controlled; strong compliance but SaaS-hosted | 🔻 Advisor-controlled; SaaS-hosted |

| Cost | Business Edition as low as $6/month/portfolio with volume discounts | High | High | Moderate (starts at $249/year) | High (~$5K+/yr per advisor seat) | Moderate (~$2.1K-$3K/yr per advisor seat) | Lower (~$1.3K-$1.5K/yr per advisor seat) |

| Accessibility | Individuals + Offices + Advisors + RIA firms | Enterprise-only | RIA contracts | Individuals + offices | Advisors + RIA firms | Advisors + RIA firms | Advisors + RIA firms |

| Asset Class Coverage | ✅ Full coverage; Public + Private (alternatives, real estate, crypto, etc.) | ✅ Full coverage; Public + Private | 🔻 Partial coverage; mostly public + custodial accounts | 🔻 Partial coverage; Public + crypto + some manual private asset entry | 🔻 Primarily financial accounts, limited alternatives/manual for privates | 🔻 Weaker alternatives/privates | 🔻 Weaker on alternatives/privates |

| Entity & Relationship Mapping | ✅ Yes - trusts, entities, beneficiaries | ✅ Yes (complex structures) | 🔻 Limited unless license extra module | ❌ No mappings | 🔻 Household/client centric; not deep entity mapping | 🔻 Household-centric; some family linkage, not entity-depth | ❌ No formal entity mapping (client + goals only) |

| Detailed Planning | ✅ Yes - liquidity, tax, projected lifetime wealth; rules-based and transactional | 🔻 Primarily historical | 🔻 Primarily historical | 🔻 Limited (basic projections, not tax/liquidity aware) | ✅ Comprehensive (goals, cash flow, tax, estate, Monte Carlo) | ✅ Comprehensive (goals, cash flow, tax) | ✅ Strong goal-based planning; limited tax/estate |

| Transaction-Level Intelligence and Analytics | ✅ Yes - IRR, multiples, cost basis, projections, cash flows | ✅ Yes (institutional analytics) | 🔻 Basic performance | 🔻 Limited (time-based return tracking) | 🔻 Limited, plan-focused, not transaction-deep | 🔻 Limited; cash flow + tax, but not transaction-deep | ❌ No (performance not transaction-level) |

| Customizable Dashboards/Workflows | ✅ Yes - configurable dashboard layouts and Apps | ❌ Rigid, institution-controlled | 🔻 Limited customization | ✅ Flexible dashboards | 🔻 Advisor portal customizable; client portal semi-rigid | ✅ Modern + flexible; strong visual planning tools | 🔻 Moderate flexibility; mostly structured workflows |

| Ease of Adoption | ✅ Office or individual onboarding | ❌ Heavy lift, requires IT staff | ❌ Firm-wide implementation | ✅ Direct + manual inputs | 🔻 Office onboard, requires training | ✅ Office onboarding | ✅ Office onboarding |

| Free Trial | ✅ 30 days | ❌ Not available | ❌ Not available | ✅ 14 days | ❌ Not available | ❌ Not available | ❌ Not available |

| Free Edition Available | ✅ Yes, sign up for Essential Edition that is free | ❌ Not available | ❌ Not available | ❌ Not available | ❌ Not available | ❌ Not available | ❌ Not available |

Financial Advisors Choose AssetView

Low cost, unified, powerful, insightful - AssetView excels